Payroll giving: help us defeat cancer with every payday

If you are thinking about setting up a regular gift to support our vital cancer research, you might want to consider making a monthly donation through your payroll. This is a very simple and tax efficient way to give to charity.

Give as you earn

There are several benefits to giving through your payroll, sometimes called ‘give as you earn’.

Your donation will come out of your pay automatically every month, and you can donate to as many charities as you wish.

Payroll giving also saves you money, because your donation is taken directly from your salary before tax is deducted. This means that your donations will be increased by tax relief – and money that would have gone to HMRC will come to your chosen charity instead.

For example, if you decide to give £20 a month, it will only cost you £16 if you pay tax at the basic rate, or £12 if you are a higher-rate taxpayer.

Why choose payroll giving?

- It’s easy – you can set up payroll giving quickly online, and you can give to multiple charities.

- It’s tax efficient – donations are made before income tax is applied, making it tax efficient.

- It’s secure – you can set up your donation without giving your bank details, as we only need your National Insurance number or payroll number.

- You’re in control – you can change or stop your gift whenever you want. Simply contact your payroll department with your request.

Work out your tax rate

Yearly income | £12,501 to £50,000 | £50,001 to £150,000 | over £150,000 |

Tax rate | 20% basic tax rate | 40% higher tax rate | 45% additional tax rate |

How much will your donation cost you?

Donation amount the ICR receives | Cost to 20% taxpayer | Cost to 40% taxpayer | Cost to 45% taxpayer |

| £10 | £8 | £6 | £5.50 |

| £15 | £12 | £9 | £8.25 |

| £20 | £16 | £12 | £11 |

How your gift makes a difference

It’s thanks to supporters like you that we’ve been able to discover and develop many of the anti-cancer drugs that are used today around the world.

Our scientists and clinicians are working to create new, more targeted treatments that cause fewer side-effects and make living with cancer more manageable.

- £10 could buy a bottle of the cell culture liquids vital to grow cancer cells for our experiments

- £50 could pay for protein analysis for a week

- £75 could go towards funding a student's tuition fees for a week, as they explore new breakthroughs in cancer research

- £100 could pay for 2 weeks of protein analysis

- £150 could buy a laboratory grade mixer to help prepare experiments

- £150 could buy a vortex machine to mix liquids in the lab

- £250 could pay for a special fridge to store samples and materials for our experiments

Whatever you decide to give, you can be sure that your regular gift is helping our scientists make the discoveries to defeat cancer.

Frequently asked questions

To give through your payroll, you need to be a UK taxpayer and you need to be receiving pay which is subject to PAYE deductions.

Your employer must also run a Payroll Giving scheme.

If they are not, they can find out more information about the benefits of offering payroll giving.

No, you can give whatever you like.

You can also choose to support multiple charities through your payroll.

You can use our online form to sign up today.

Once you have completed the form, you will receive a confirmation email and your request will be passed onto your employer who will set up your regular donation.

Alternatively speak to your company’s payroll department for a sign-up form.

Your payroll gift(s) will stop when you leave your employment.

When you start your new job, remember to set them up again.

Useful links

- Payroll giving (Government website)

- Working with employers (Association of Payroll Giving Organisations' website)

- ICR payroll giving donation form

Any queries?

Our Supporter Care team is here to help. Please contact us on 020 7153 5387 or [email protected] if you have any queries about setting up your payroll gift.

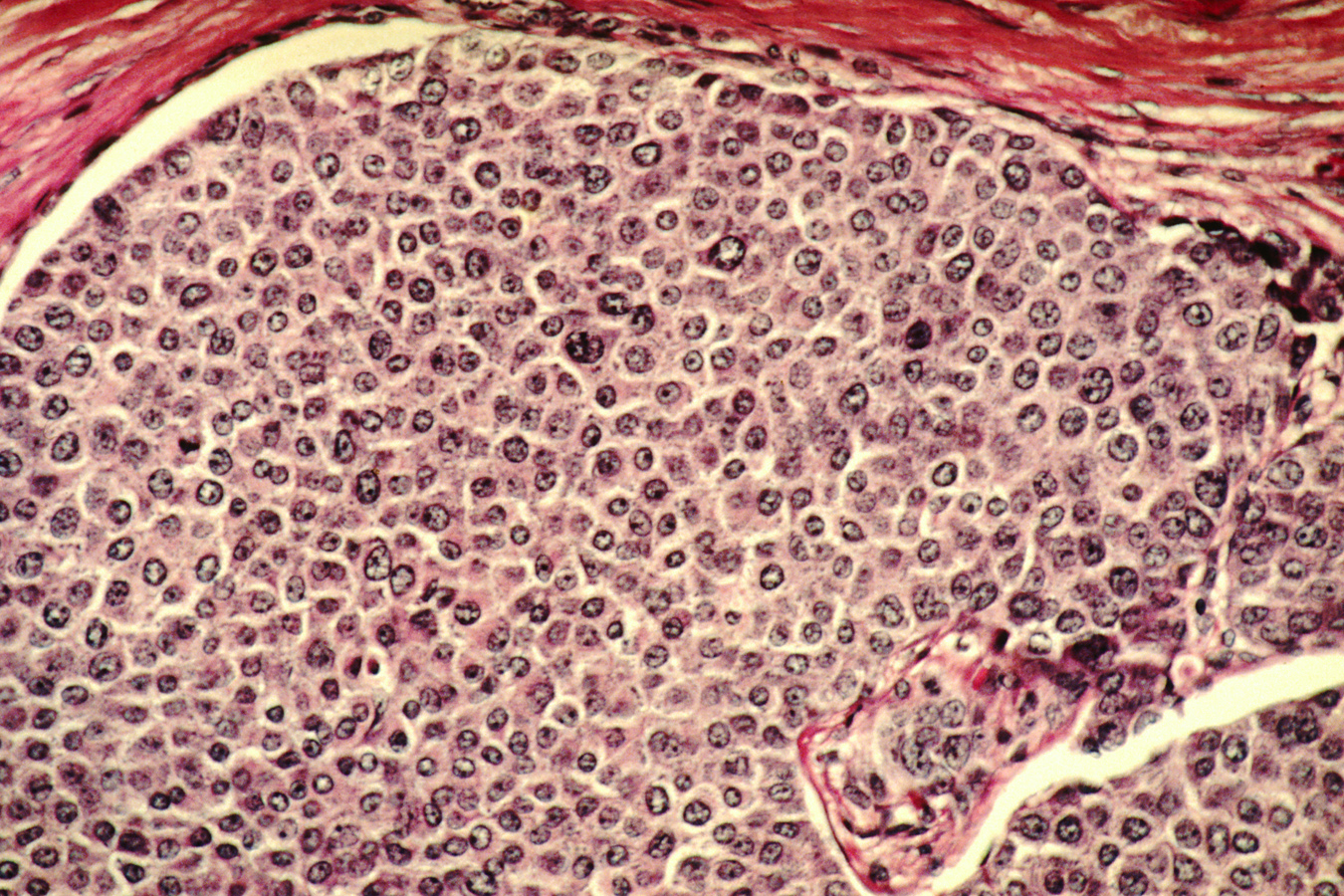

New weakness to target breast cancer cells discovered

945x532.png?sfvrsn=310c2acf_2)